We know it's getting warmer. That's not the point

"The planet has been warming," says a new study of temperature records, conducted by Berkeley professor Richard Muller. I wonder what he'll be telling us next: that night follows day? That water is wet? That great white sharks have nasty pointy teeth? That sheep go "baaaa"?

No, the only surprising part of the results of the Berkeley Earth Surface Temperature Project is the good professor's chutzpah in trying to present them as new or surprising – let alone any kind of blow to the people he calls "skeptics" (or, when speaking to his friends at the Guardian, "deniers").

Here's the money quote from a ramblingly disingenuous piece he wrote in The Wall Street Journal, (which frankly should have known better than to fall for this guff):

Without good answers to all these complaints, global-warming skepticism seems sensible. But now let me explain why you should not be a skeptic, at least not any longer.

Let me explain what is going on here. And you can trust me: I'm not a climate scientist. What I am is someone eminently more qualified to deconstruct the semantic skullduggery going on here: a student of language, rhetoric and grade one bullshit.

In the first half of his piece, Professor Muller sets up his straw man. He does so by ascribing to "skeptics" views that they don't actually hold. Their case, he pretends for the sake of his wafer-thin argument, rests on the idea that the last century's land-based temperature data sets are so hopelessly corrupt that they have created the illusion of global warming where none actually exists.

No it doesn't. It has been a truth long acknowledged by climate sceptics, deniers and realists of every conceivable hue that since the mid-19th century, the planet has been on a warming trend – emerging, as it has been, from a widely known phenomenon known as the Little Ice Age. A period which in turn was preceded by the even better known Medieval Warming Period.

This is why the standard rebuttal to the term "climate change denier" is: "But I don't deny that climate changes. I recognise that it has done so since the dawn of time. What I question is not the process of climate change, but what causes is it, whether it represents a problem and whether there's anything we can do about it other than sensible mitigation."

But obviously, "Berkeley professor tells us nothing new under the sun" doesn't make such a good story. What's required in cases like this is a bit of judicious spin. So that's just what Professor Muller does: having first set up his straw man he then sets out to knock it down by revealing – ta da! – that whatever those pesky sceptics say the world definitely did get warmer in the Twentieth Century.

Except, duh! We know that. That's why sceptics are forever saying stuff like: "Yes, the planet did warm in the Twentieth Century. But only by about 0.7 degrees C, which is hardly a major threat". And: "Yes, the planet did warm in the Twentieth Century but what's your point? That there's some ideal, earlier colder average temperature that we should all strive to recreate by bombing our economy back to the dark ages?"

So why are notionally respectable journals like The Economist and New Scientist trying to make out that is a story is a seismic event which shatters forever the case of global warming sceptics?

Well, I suppose the polite possibility – perhaps my colleague Tom Chivers can help out here – is that they've simply never bothered to find out what climate change sceptics actually think.

My personal suspicion, though, is that springs from desperation.

The case for AGW theory has been getting weaker by the minute, as Marc Morano notes in this characteristically feisty summary of the current state of play:

The Antarctic sea ice extent has been at or near record extent in the past few summers, the Arctic has rebounded in recent years since the low point in 2007, polarbearsare thriving, sea level is not showing acceleration and isactuallydropping, Cholera and Malaria are failing to follow global warming predictions, Mount Kilimanjaro melt fears are being made a mockery by gains in snow cover, globaltemperatures have been holding steady for a decade or more, deaths due to extreme weather are radically declining,global tropical cyclone activity is near historic lows, thefrequency of major U.S. hurricanes has declined, the oceans are missing their predicted heat content, bigtornados have dramatically declined since the 1970s,droughts are not historically unusual nor caused by mankind, there is no evidence we are currently having unusual weather, scandals continue to rock the climate fear movement, the UN IPCC has been exposed as being a hotbed of environmental activists and scientists continue to dissent at a rapid pace."

Morano also, incidentally, has links to all those scientists – Pielke Snr, Lubos Motl, et al – pouring cold water on Muller's ludicrous claims. I don't think I've heard Morano sound quite so angry or contemptuous: "Muller's WSJ OPED is designed to confuse the public with perhaps some of the most banal and straw man arguments yet put forth by a global warming activist."

And I don't blame him.

What is going on is exactly the kind of utterly reprehensible dishonesty and trickery I anatomise more thoroughly in Watermelons. The Warmists lost the battle over "the science" long ago; that's why the best they can do now is resort to the kind of risible semantic ruse like this deliberate conflation of "global warming" with "man made global warming".

The two concepts are entirely separate: all sceptics believe in "global warming" (depending on what time scale you use); what they doubt to various degrees is the "man made" element. Richard Muller has crassly fudged this distinction to make a point which has nothing to do with science and everything to do with gutter politics.

And even more disgracefully, rather than pause to question this semantic skullduggery – as any half-way decent, responsible journalist should have done, on whatever side of the debate – ma

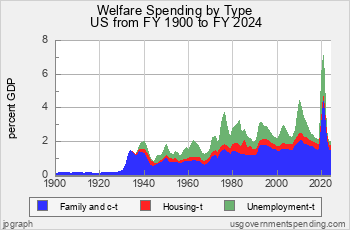

- Transfer to state and local

- Transfer to state and local - Federal direct spending

- Federal direct spending - State direct spending

- State direct spending - Local direct spending

- Local direct spending